Latest Version

Version

1.0.0

1.0.0

Update

September 26, 2025

September 26, 2025

Developer

FreeTaxCalculator.co.uk

FreeTaxCalculator.co.uk

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

uk.co.freetaxcalculator.freetaxcalculator

uk.co.freetaxcalculator.freetaxcalculator

Report

Report a Problem

Report a Problem

More About UK Tax & Salary Calculator

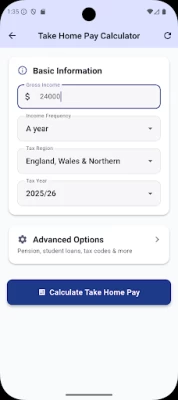

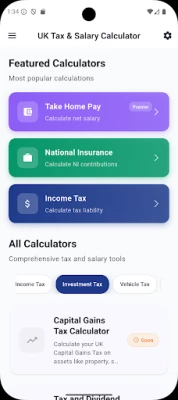

UK Tax Calculator & Salary Calculator gives you everything you need to understand your pay and taxes in the UK. Whether you’re checking your payslip, planning your salary, or estimating taxes, this app provides accurate results for income tax, National Insurance, take-home pay, pensions, and more.

Perfect for anyone in the UK who needs a reliable salary calculator or tax calculator updated with the latest HMRC rules.

Key Features

💷 Salary Calculators

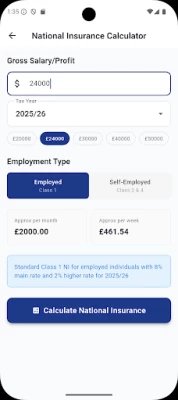

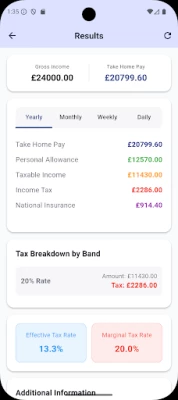

Salary Calculator UK – Calculate your take-home pay after tax & NI

Gross to Net Calculator – Convert gross salary to net pay instantly

Salary Breakdown Tool – Full payslip-style breakdown (tax, NI, pension, student loan)

📊 Tax Calculators

UK Tax Calculator – Income tax calculations for 2024/25 & 2025/26

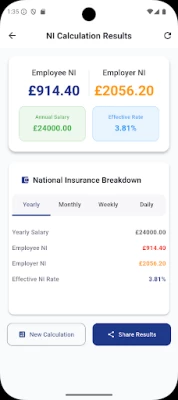

National Insurance Calculator – Class 1 NI contributions

Capital Gains Tax (CGT) Calculator – Property, shares, and crypto

VAT Calculator – Add or remove VAT quickly

⚙️ Advanced Features

Multiple tax years: 2021/22 → 2025/26

UK & Scotland regional tax support

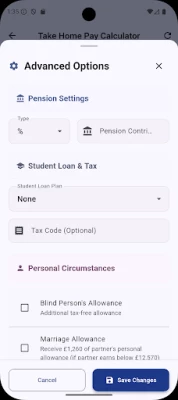

Student loan repayment estimates (Plan 1, Plan 2, Plan 4, PG)

Pension contribution adjustments (fixed or %)

Marriage allowance eligibility

Tax code support (1257L, BR, D0, emergency, K codes)

Personal allowance tapering for £100k+ incomes

📱 User-Friendly Design

Professional salary & tax interface

Works on phones and tablets

Dark & light theme support

Fast, secure, and ad-free

Who Is It For?

✔️ Employees checking take-home salary

✔️ Contractors & freelancers estimating tax bills

✔️ Self-employed workers planning finances

✔️ HR teams & accountants needing quick checks

✔️ Anyone looking for a trusted UK Salary Calculator or Tax Calculator

Why Choose This App?

✅ Accurate salary calculator UK – always up to date

✅ Official HMRC tax year rules built in

✅ Privacy-first – no personal data stored

✅ Easy to use – results in seconds

Disclaimer

This app provides estimates only. For official advice, please check HMRC or consult a tax professional.

Key Features

💷 Salary Calculators

Salary Calculator UK – Calculate your take-home pay after tax & NI

Gross to Net Calculator – Convert gross salary to net pay instantly

Salary Breakdown Tool – Full payslip-style breakdown (tax, NI, pension, student loan)

📊 Tax Calculators

UK Tax Calculator – Income tax calculations for 2024/25 & 2025/26

National Insurance Calculator – Class 1 NI contributions

Capital Gains Tax (CGT) Calculator – Property, shares, and crypto

VAT Calculator – Add or remove VAT quickly

⚙️ Advanced Features

Multiple tax years: 2021/22 → 2025/26

UK & Scotland regional tax support

Student loan repayment estimates (Plan 1, Plan 2, Plan 4, PG)

Pension contribution adjustments (fixed or %)

Marriage allowance eligibility

Tax code support (1257L, BR, D0, emergency, K codes)

Personal allowance tapering for £100k+ incomes

📱 User-Friendly Design

Professional salary & tax interface

Works on phones and tablets

Dark & light theme support

Fast, secure, and ad-free

Who Is It For?

✔️ Employees checking take-home salary

✔️ Contractors & freelancers estimating tax bills

✔️ Self-employed workers planning finances

✔️ HR teams & accountants needing quick checks

✔️ Anyone looking for a trusted UK Salary Calculator or Tax Calculator

Why Choose This App?

✅ Accurate salary calculator UK – always up to date

✅ Official HMRC tax year rules built in

✅ Privacy-first – no personal data stored

✅ Easy to use – results in seconds

Disclaimer

This app provides estimates only. For official advice, please check HMRC or consult a tax professional.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Peacock TV: Stream TV & MoviesPeacock TV LLC

Mr.Billion: Idle Rich TycoonIDSIGames

Ludo King®Gametion

WPS Office-PDF,Word,Sheet,PPTWPS SOFTWARE PTE. LTD.

TCG Card Store Simulator 3DBlingames

Statastic Basketball TrackerStatastic Solutions FlexCo

FatsomaFatsoma Android

3D Chess GameA Trillion Games Ltd

RealVNC Viewer: Remote DesktopRealVNC Limited

Truth or Dare Game - OweeOwee

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD